The Curiosity Advantage: Viral Gandhi on Turning Clinical Insight into Investor Confidence

Key Takeaways for Medtech Innovators & Investors

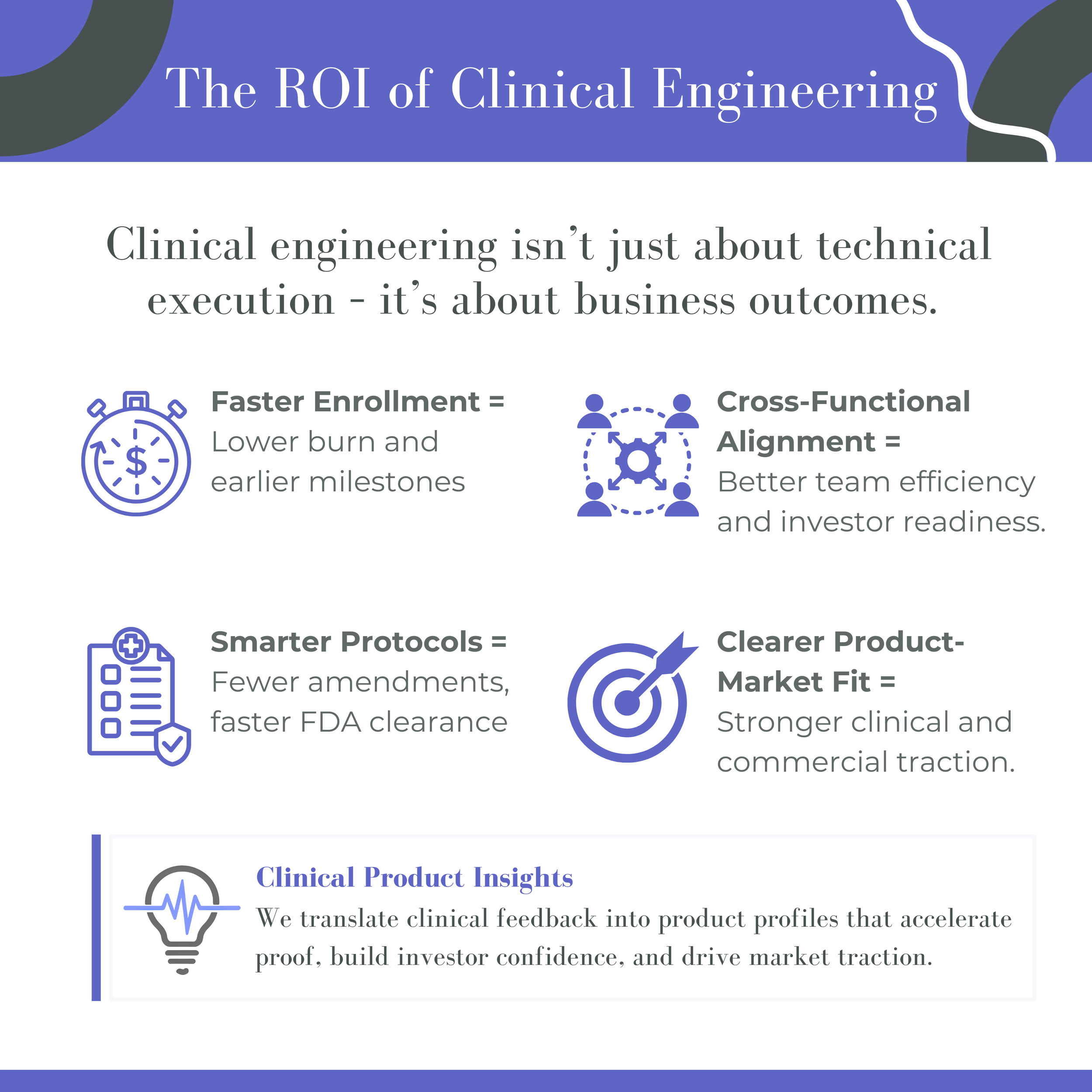

Clinical engineering is a strategic function—not just a technical one. It bridges product design, clinical trial execution, and market adoption, making it essential to medtech success.

Early clinical input de-risks investment by informing target product profiles, trial design, and user workflows.

Embedding clinical engineering from the outset builds credibility, accelerates trials, and creates a clearer path to market.

Clinical engineers are cross-functional multipliers in lean teams - supporting procedures, training teams, and preparing investor-facing communications.

Curiosity reveals opportunities. Whether you're building or investing, it helps uncover product blind spots and avoid costly design pivots.

For companies building toward commercialization, CPI helps align clinical insight with engineering, regulatory, and market goals to accelerate adoption.

Introduction

What do investigative journalism, clinical engineering, and venture capital have in common?

For Viral Gandhi, Principal at KCK Medtech, the answer is curiosity. In today’s medtech landscape, where capital is tight and trial timelines are unforgiving, curiosity is more than a mindset—it’s a competitive edge.

For this episode of Coffee with Clinical Engineers, I met up with Viral at Voyager Coffee on Stanford’s campus to talk about his unconventional path from Financial Times journalist to clinical engineer at Edwards Lifesciences to medtech investor. His story is a compelling case for why clinical engineering isn’t just a technical role, it’s a strategic tool for medtech success, investment readiness, and capital efficiency.

In this conversation, I asked Viral what he's learned from working both sides of the table—and how clinical insight shapes the products and teams he backs.

Q&A: Curiosity, Clinical Engineering, and Investing with Viral Gandhi

Career Journey & Current Role

Emma: Let’s start with your current role. What do you do at KCK, and how did you get here?

Viral: I’m a Principal at KCK Medtech, a venture firm focused exclusively on medical devices. I joined as a consultant and eventually came on full-time. Before that, I spent nearly a decade at Edwards Lifesciences, starting as a clinical engineer on the TAVR program, Sapien XT and Sapien 3. That was a phenomenal experience working on such a transformational product. I was scrubbing into the early cases, translating clinical feedback back to engineering, and helping define what clinical engineering even meant at the time.

From Investigative Journalism to Clinical Engineering

Emma: You actually started your career as a journalist. How did that influence your work in clinical engineering?

Viral: It had a major impact. I was just a 22-year-old fresh grad, but I got to interview Nobel Prize winners, FDA leaders, investors, and physicians—people who normally wouldn’t give someone like me an hour of their time. That experience taught me how to ask the right questions and spot patterns across the healthcare ecosystem.

That mindset carried into clinical engineering. You’re in the OR, observing everything. It’s not just the device, but the workflow, the team dynamics, and the patient experience. You’re asking: What’s working? What’s not? Where’s the friction?

It’s like building a mosaic. You gather all these little pieces—clinical feedback, procedural nuance, user behavior—and try to make sense of the whole picture. That’s what I loved about journalism, and it’s what I love about clinical engineering too.

![]() CPI Lens

CPI Lens

In our consulting work, we’ve seen that founders who apply curiosity methodically by listening across OR teams, workflows, early adopters, and skeptics make sharper product bets and avoid costly pivots.

Clinical Engineering as Investment Strategy

Emma: How did that clinical engineering experience shape your investment strategy?

Viral: It’s foundational. When I evaluate a company, I’m thinking: Can this be adopted clinically? Can we enroll the trial quickly? What’s the operator workflow? For example, in one of our previous investments, we started by doing landscape analysis of the unmet needs in heart failure. We built a target product profile before investing—efficacy we’d need to show, safety we’d need to hit, type of operator that would adopt, and the enrollment feasibility. That clinical lens towards product-market fit de-risks the investment.

![]() CPI Lens

CPI Lens

For companies building toward commercialization, clinical strategy consultants like CPI help translate user needs into product decisions. We align clinical insight with engineering, regulatory strategy, and market development for cohesive growth.

Faster to Proof, Faster to Funding — How to Deliver Clinical Speed

Emma: You mentioned enrollment speed as a key metric. Can you expand on that?

Viral: Absolutely. In the early-stage startup setting, it will often be about how fast you can enroll a study. If your burn rate is $1M/month and you can enroll a trial three months faster, that’s $3M saved. For a startup that’s huge.

You have to remember, it isn’t just technology innovation, it could also be protocol changes that lead to big gains. Sometimes, a well-intentioned protocol requirement can introduce unintended workflow friction at the site level. Revisiting those elements can ease coordinator burden and unlock faster enrollment. Clinical engineering can make that happen by tweaking protocols, improving site training, or identifying friction points early. It’s not just about the device; it’s about the whole system.

“You can’t just build a cool device. You have to know who it’s for, how it’ll be used, and whether you can prove it works—fast.”

The ROI of Clinical Engineering

In today’s more competitive healthtech investment climate, demonstrating clinical value quickly is essential. Integrating clinical engineering into the development cycle positions companies for faster, more successful market entry.

Advancing Clinical, Product, and Commercial with a Lean Team

Emma: In early-stage startups, you often don’t have the luxury of hiring for every specialized role. How do you see portfolio companies managing that?

Viral: That’s where clinical engineers really shine. They’re incredibly versatile. You need someone who can support a case one day, build a training deck the next, and pitch to investors the day after. Startups have to move fast, and you can’t always wait to hire the perfect person for every role. Sometimes you’ve got a CEO who’s commercially strong but less clinical, or a head of clinical who knows process but not the therapeutic area. You work with what you have—and that’s why having someone who can bridge across clinical, engineering, marketing, and strategy is so valuable. It’s about pulling together insights from different sources and making them useful—whether it’s for FDA docs, site training, or investor presentations.

![]() CPI Lens

CPI Lens

We understand startups. Your FDA submission milestone is looming, the pilot site’s not locked, and you’re juggling V&V with Gen 2 requests - all while your board wants answers. CPI supports clinical, product, and commercial tracks in parallel so you can push forward without bottlenecks.

Clinical Engineering Across Medtech

Emma: Do you see clinical engineering outside of robotics and cardiology?

Viral: I think it’s needed in all of medtech. In startups, you may not have a formal “clinical engineering” title, but someone needs to play that role. At a large company, you may have both a field specialist and an engineering person in the room. At an early-stage company, our field specialists were essentially clinical engineers—they were in the cases, feeding insights back to engineering, helping shape the protocol. That feedback loop is critical.

Advice for the Curious Builder-Investor

Emma: Any advice for someone exploring clinical engineering or medtech investing?

Viral: They are both such interesting career paths, right? Both paths are about being the hub in a hub-and-spoke model. You’re the bridge between clinicians, engineers, marketers, and investors. There’s no one right way to do it—but curiosity will get you in the room, build relationships to solve problems, and keep you learning.

“Curiosity is your superpower - whether you’re building or investing.”

Clinical Strategy That Builds Investor Confidence

Viral’s journey from investigative journalism to medtech investing shows how curiosity and pattern recognition drive the strategic product decisions that position companies for investment. It’s a perspective we share at CPI, where we work with teams to connect clinical insight to strategic execution.

In our experience, the strongest medtech products gain traction when clinical insight, storytelling, and capital strategy are aligned from the start. We help teams integrate these elements early, so they can reduce trial risk, accelerate development, and execute with the product clarity investors look for.

Preparing to raise, launch, or refine your clinical strategy? Let’s talk.

Related Links

CPI on LinkedIn – Follow CPI for insights, updates, and case studies.